Why Precious Metals Are Essential for Securing Your Retirement

As you plan for retirement, protecting your savings from market volatility, inflation, and economic uncertainty is paramount. Precious metals like gold and silver are more than just assets—they are a cornerstone of a diversified retirement portfolio that safeguards your wealth for years to come. Discover why precious metals are essential for securing your retirement.

The Role of Precious Metals in Protecting Your Wealth

Precious metals, such as gold and silver, have long been regarded as safe-haven assets, offering a hedge against economic uncertainty and market volatility. Unlike paper currencies, which can lose value due to inflation or government policies, precious metals maintain intrinsic worth derived from their rarity and universal demand.

By incorporating precious metals into your investment strategy, you can diversify your portfolio and create a financial safety net that stands resilient against the unexpected.

Preserving Your Buying Power with Gold

Gold serves as a hedge against inflation and currency devaluation, maintaining its value while other assets falter. Adding gold to your retirement portfolio helps preserve your purchasing power, ensuring your hard-earned savings retain their worth over time.

Don't Keep In Cash

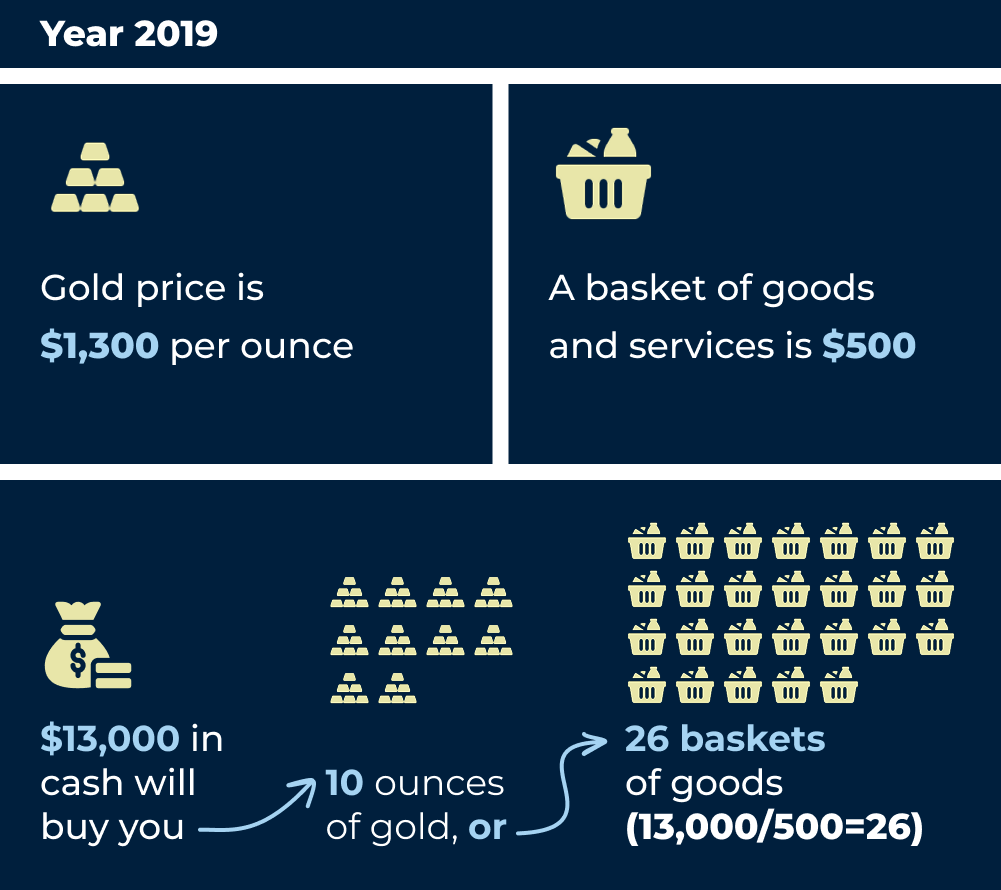

Instead of using your $13,000 in cash to buy traditional goods and services, you decide to invest that money into gold.

At a price of $1,300 per ounce, you can purchase 10 ounces of gold (13,000/1,300).

Store in Gold

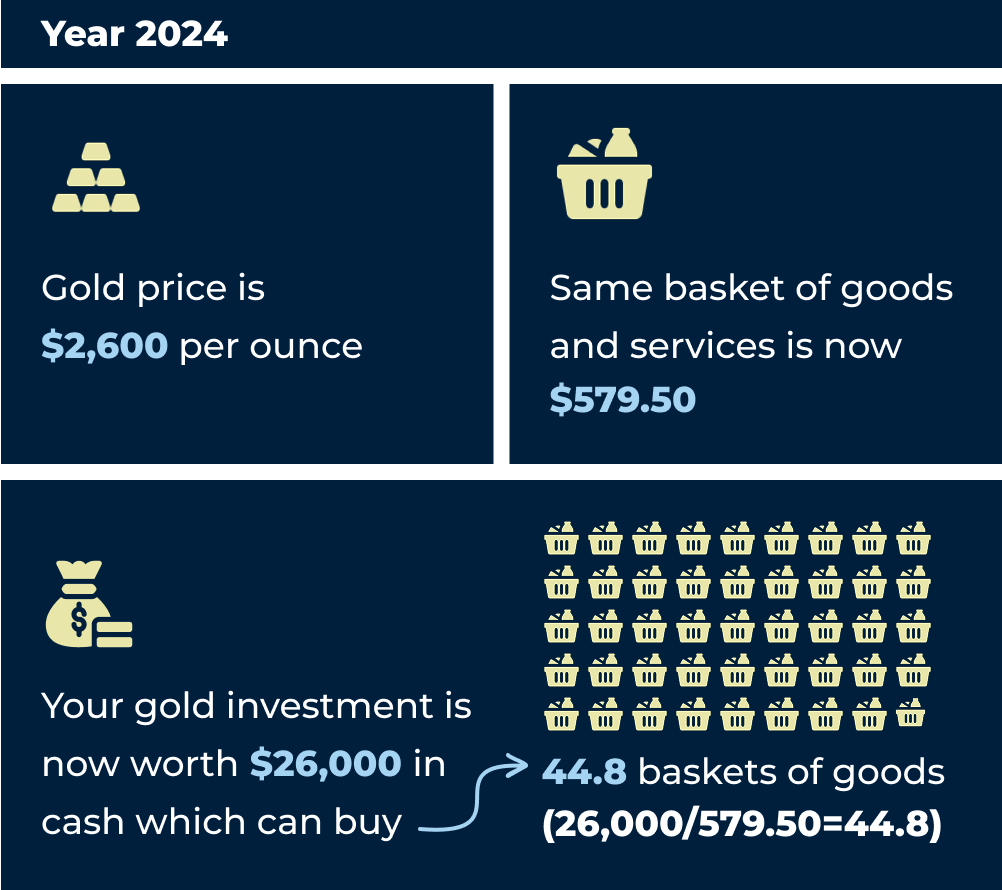

By storing your assets in gold, you protected your wealth from inflation.

The 10 ounces you purchased in gold in 2019 is now worth double, allowing you to buy more than 72% more in goods and services in 2024 than in 2019.

despite the increase in goods and services due to inflation, the value of your gold investment grew more significantly, effectively retaining and enhancing your purchasing power over the 5-year period.

Understanding Inflation and Its Effect on Retirement Savings

Inflation poses a serious threat to your retirement. Without proper planning, it can erode the value of your savings, leaving you with less buying power when you need it most.

Why Inflation Erodes Your Purchasing Power

Inflation, the gradual rise in prices for goods and services over time, erodes the purchasing power of money, making it a significant concern for savers and investors. When inflation trends upward, your dollar buys less than it did before, leading to higher costs for everyday necessities and a diminished value of cash-based savings. Inflation is often influenced by various factors, including increased demand for products, supply chain disruptions, and expansive monetary policies such as printing more money or lowering interest rates.

Understanding inflation trends is crucial for protecting your wealth. When inflation spikes, traditional investments like stocks and bonds can suffer as their real returns are diminished by rising prices. In such times, investors often turn to assets that historically perform well in inflationary environments, such as precious metals. Gold and silver, in particular, have long been viewed as a hedge against inflation because their value tends to rise when fiat currencies lose their purchasing power.

How Precious Metals Perform During Inflationary Times

Precious metals offer a stable store of value during inflationary periods because they are tangible assets that aren't subject to the same vulnerabilities as paper currencies. As inflation drives down the value of the dollar, demand for metals like gold and silver increases, pushing their prices upward.

This makes them an attractive option for safeguarding wealth, especially during periods of economic uncertainty. By including precious metals in your investment portfolio, you create a buffer against inflation, helping to preserve the real value of your wealth and providing peace of mind in uncertain times.

Investing in a Precious Metals IRA: A Smart Strategy for Retirement

A Precious Metals IRA allows you to combine the stability of precious metals with the tax advantages of a retirement account, making it an ideal choice for securing your financial future. By incorporating tangible assets like gold and silver into your retirement plan, you can safeguard your wealth from market volatility and economic uncertainty while benefiting from the potential for long-term growth.

The Benefits of a Precious Metals IRA

Diversification: Balancing your portfolio with tangible assets reduces risk and enhances long-term stability. Precious metals complement traditional investments, providing a layer of protection against economic downturns and currency fluctuations.

Tax Advantages: Precious Metals IRAs offer the same tax benefits as traditional and Roth IRAs, including tax-deferred growth or tax-free withdrawals. This means your investments can grow over time without the immediate burden of taxes, allowing you to maximize your retirement savings.

Protection Against Volatility: Gold and silver act as a hedge against market downturns, ensuring your retirement savings remain secure. When stocks and bonds falter, precious metals often retain or increase in value, preserving your purchasing power during uncertain times.

By investing in a Precious Metals IRA, you can build a retirement portfolio that is not only diverse but also resilient, giving you the peace of mind to enjoy your golden years.

Ready to Safeguard Your Retirement?

Transitioning a portion or entirety of your retirement account to a precious metals IRA offers a logical strategy. Aligning your investment approach with changes in objectives, life stage, or market conditions ensures a buoyant and secure retirement plan.

Allocating a portion of your retirement funds to physical precious metals empowers you to create a diversified and resilient portfolio that stands strong against the unpredictable tides of the financial world, providing a stable foundation for your retirement years. Don’t wait until it’s too late—take control of your financial future today.

Contact U.S. Gold Bureau for Expert Guidance

The U.S. Gold Bureau specializes in helping investors integrate precious metals into their retirement plans. Our experienced advisors can guide you through every step, from setting up a Precious Metals IRA to selecting the right assets for your goals.

Secure your retirement with the stability of precious metals. Contact the U.S. Gold Bureau today and discover how gold and silver can help protect your financial future.